Introduction: A New Era for Superannuation

Australia is entering the 2025–2026 financial year. Superannuation remains vital for long-term financial security. The Superannuation Guarantee (SG) rate, a core part of this system, has reached its legislated 12%. This is not a small increase. It’s a major milestone. Many Australians now ask: How can I best use this 12% rate for my retirement readiness?

Australians increasingly focus on key superannuation topics. Moving beyond just the current superannuation rate, there’s growing interest in the superannuation rate 2026 and a widespread desire for a super rate forecast. People also consider benchmarks like how much super should I have at 40. This keen public interest highlights a strong desire for financial literacy and long-term planning.

Australians consistently follow these changes. They actively track the current super rate, superannuation rate 2024, and superannuation rate 2025 as the SG rate progressed. Even discussions about the super rate 2025 show this forward-looking approach.

The 12% Super Guarantee Rate: Stability Ahead

Good news for your retirement planning: From 1 July 2025, the superannuation rate for SG contributions is officially 12% of your ordinary time earnings (OTE). This completes the government’s decade-long plan to boost retirement savings. The superannuation rate has steadily risen since 2021. It is now expected to stay at 12% for the foreseeable future.

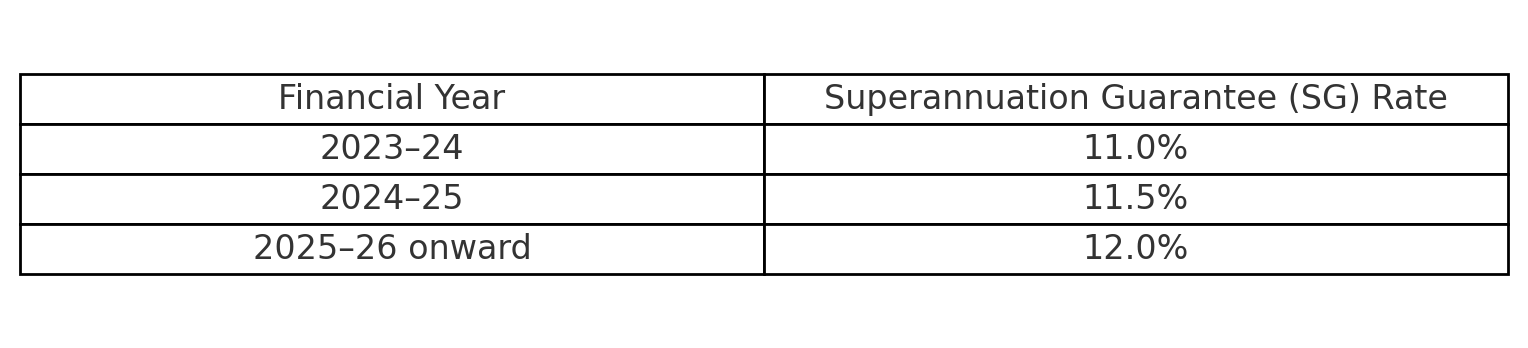

Here’s a quick look at recent increases:

With a stable superannuation rate now in place, Australians can confidently plan their retirement outcomes. This stability brings more certainty. It benefits employers, employees, and members of self-managed super funds (SMSFs). Ongoing discussions about the super rate and superannuation rate confirm people still need clear, current information.

Maximising Your Super: Contributions and Targets

Your super journey involves more than just the SG rate. Consider two other key areas: contribution limits and age-based targets.

Understanding Contribution Caps

As of July 2025, the concessional contributions cap is still $30,000 per year. These are before-tax contributions. They include your employer’s SG payments and any salary-sacrificed amounts. For after-tax contributions, known as non-concessional contributions, the cap remains $120,000. Remember the bring-forward rule? This rule lets you contribute up to $360,000 over three years. These amounts align with the stable superannuation rate environment.

Superannuation Targets by Age

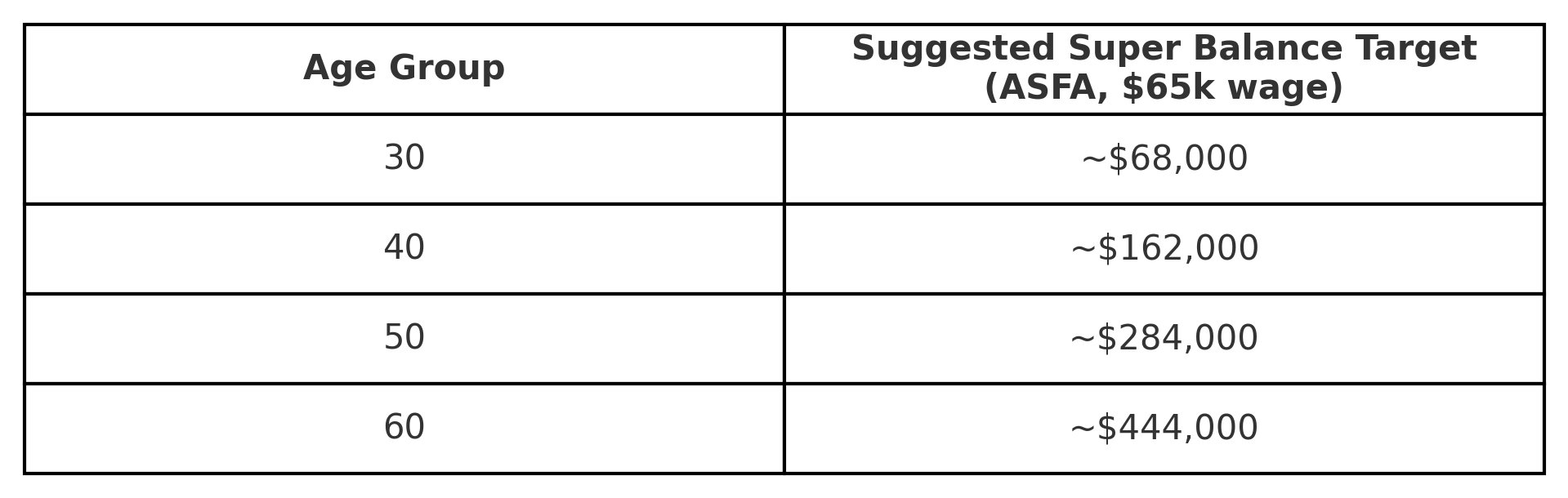

Many Australians consider super benchmarks. The Association of Superannuation Funds of Australia (ASFA) offers general guidance. This helps you check your progress:

To learn more about reaching these targets, explore How Much Super Do You Need to Retire?

Beyond the SG Rate: Inflation, Returns & Diversification

The superannuation rate is now 12%, but rising inflation and uncertain real returns make voluntary super contributions more important than ever. According to the Reserve Bank of Australia (RBA), inflation is expected to remain between 2.5% and 3%, which means your superannuation investments must consistently outperform inflation to protect your purchasing power and manage the growing cost of living in retirement.

To stay ahead, many Australians are adopting a diversified superannuation portfolio that balances growth, income, and defensive assets. This strategy can help deliver stable long-term returns, minimise risk, and enhance your ability to meet retirement income goals, even in a high-inflation environment.

Choosing Your Super Fund: A Smart Comparison Guide

The superannuation rate is now set. So, Australians need to look beyond just the contribution rate. Actively consider your fund’s performance. It is crucial to compare super fund options. Base your choice on key factors:

- Fees: Check administrative, investment, and indirect costs. These can reduce your returns.

- Long-term investment performance: How has the fund performed over many years?

- Insurance cover: Does it offer life, Total and Permanent Disability (TPD), and income protection you need?

- Digital tools and member services: Do they make managing your super easy?

Beyond standard super funds, investors seeking varied income streams might explore products like the Trivesta Protected Yield Fund (TPYF). This high-quality managed fund offers a fixed-income alternative for Australian investors. It aims for stable income and capital protection.

Key features of TPYF include:

- 10% p.a. Target Return (Net of Fees): The fund aims for a 10% annual return. It pays this on a set schedule.

- Monthly and Semi-Annual Payouts: Investors receive a fixed 0.5% monthly payment. They also get bonus payments of 2% in the sixth and twelfth months. TPYF provides a steady, fixed monthly income. This is unusual for typical bond or cash funds.

- Fully Redeemable & Flexible: TPYF allows full redemption monthly with no penalty. This gives investors quick access to their money. Unlike term deposits, you can withdraw funds with simple notice.

Accessing Your Super: Understanding the Rules

The superannuation system is mainly for retirement. However, strict legal provisions allow early access. These are sometimes called loopholes to access super. They are regulated exceptions, not loopholes. They include:

- Compassionate grounds: For severe medical bills or funeral costs.

- Severe financial hardship: You must meet specific criteria.

- Terminal medical condition: If you have a life-threatening illness.

- Temporary or permanent incapacity: If you cannot work due to illness or injury.

- First Home Super Saver (FHSS) Scheme: To save for your first home deposit.

The ATO manages these applications. They require much documentation. Always seek professional advice if you consider early access.

Superannuation Policy: What’s on the Horizon?

No changes to the superannuation rate are currently legislated beyond 2026. However, Australians should always stay alert for future reforms. These could include changes to tax thresholds. Also, reviews of the preservation age (when you can access your super), and adjustments to contribution caps might happen. Staying informed helps navigate your superannuation journey.

Final Thoughts on Superannuation Planning

The superannuation rate is now at its legal peak of 12%. Australians are entering a new phase. It’s more important than ever to compare super fund options.

Maximise voluntary contributions. Understand the rules for accessing super (including perceived loopholes to access super).

The continuing public discourse around terms like current super rate, current superannuation rate, superannuation rate 2024, and the broader super rate shows Australia is actively thinking about its financial future. Looking at different investment options, like fixed-income alternatives such as the Trivesta Protected Yield Fund, can strengthen your retirement plan.

Your Next Steps for Financial Security

Are you tracking the superannuation rate 2026? Are you checking if your super is on target for retirement? Do you want to learn how to compare super fund options?

Staying informed will help secure your financial future. Use this guide to make proactive choices for your retirement goals. Taking these steps can help you build a robust financial future, even in a changing economic environment.